Context for Firm Strategy and Company Rivalry

Climate for Investments

Macroeconomic Conditions

GDP

Brazil's has the seventh largest economy in the world by GDP. The largest sectors of the economy are the service and industrial, followed by agriculture. Their strong domestic market has made them resistant to the recession affecting the rest of the world, and largely because of this, Brazil has become one of the fastest growing economies in the world until very recently. According to the World Bank, GDP slowed significantly from 7.5% in 2011 to 0.09% in 2012.

Unemployement

In spite of the slowdown in growth, unemployment remains at a record low of 5.4%. More people have jobs now than ever before and the middle class is growing due to the previous years GDP growth. While this is good for the population it is bad for industry, because it makes the cost of wages go up, which makes competition difficult and discourages investment. Unless GDP goes back up this may lead to layoffs and in increase in unemployment.

Inflation

Another consequence of low unemployment and wage increases is inflation, which reached 6.5% as of 05/08/13 according to the Extended National Consumer Price Index (ICPA). The consumer price index has risen at the fastest rate since 2005, driven by increases in food prices. In order to control this, the government has taken measures such as pushing down interest rates, cutting taxes, encouraging lending and developing infrastructure projects.

Government Stability

For the most part Brazil is politically stable and an open market for foreign investments. Although the levels of political risk are lower, this has to be weighed against the bureaucracy, high taxes, corruption, and legal and tax complexities that are far greater than in other countries. Unless the government can find a way to remedy these issues the rate of industrial production will contract which will lead to a declining rate of investment.

Microeconomic Conditions

Tax Structure

The main rules regarding Brazil's tax structure is provided by the Federal Constitution, which was enacted in 1988. The federal constitution determines the general rules on taxation, such as, limitations on the power to tax, and also how the money is dispersed throughout the various levels of governments. The three levels that are allowed to tax by the national Tax System are the Union, Federal District, and the Municipalities. Federal taxes come from many different areas such as, revenue and sales, importation of goods, importation of services, and profits and net income. Federal taxes are also comprised of Social Security Taxes (INSS and FGTS) and levies against financial transactions. State taxes are gathered from the circulation of merchandise and on the rendering of interstate and inter-municipal transportation services in accordance with the 1988 constitution. Since collection of this tax is up to the state, each state has their own rules regarding the calculation, rates, payments, and accessory obligations. This can be troublesome for companies that work in different states, because of the varying compliance requirements. The Brazilian tax system is very complex and often leads to an environment where taxpayers are required to comply with many different obligations, such as comprising tax collection and reporting. These complexities also led to foreign businesses worrying about such complexities and unpredictability of Brazil's taxes, than the total burden of them. Many locals regard the long tax battles that they go through as just another cost of doing business with the taxman. The complexity of the tax system in Brazil will hinder the growth of international companies in clusters throughout Brazil. It will also hinder companies from expanding to different states, because of the varying state tax regulations.

Corporate Governance System

In the early 2000s, Brazil was seen to have a relatively weak corporate governance. In response to this claim, the Sao Paulo Stock Exchange established special listing levels for companies with high corporate governance standards. The three high-governance markets that where created are as followed: Level 1, Level 2, and Novo Mercado. Level 1 requires companies to provide additional stock liquidity and disclosure practices. Level 2 requires more shareholders' rights and a board of directors to be established. Novo Mercado requires all of the previous rules, but also it requires companies to issue voting shares only. These three markets contributed to a surge of initial public offerings, which were nearly nonexistent until 2004, and a sharp rising in both trading volume and liquidity. Also, this helped end the shrinking number of listed companies. Corporate governance practices improved greatly between the years 2004 and 2009. These factors improved Brazil's corporate governance and made companies turn and look at Brazil as a possible place to start or expand their business. With a new found faith in Brazil's corporate governance, clusters began to emerge throughout the different Brazil states. When both people and companies have confidence in a country's market, the economy grows, which in turn makes it attractive for businesses to expand and new businesses to emerge.

Labor Market Policies

Brazil is classified as a middle-income country. Brazil suffers from many different structural problems, such as a high level of income inequality and poverty levels, low qualifications of the labor force, and a high informality within the labor market. Through the resurgence of the corporate governance and faith in the economy, the unemployment rate fell strongly from 10.1% to 7.8% between the years 2001 and 2008. This shows that more companies were emerging, and that established companies were adding more jobs, and putting the Brazilian people back to work. Informality is one of the major issues that plague the Brazilian labor market, since the county has a high concentration of these types of workers. Informal workers are defined as persons that are employed outside the common industrial sector, such as self-employed individuals, domestic maids, those that produce for their own consumption, or unpaid workers. The prime age workers of Brazil have the lowest informality rates, compared to older and younger ones. Younger workers view the informal market as a way into the labor market, and occasionally find a job that goes along with their schooling. After gaining their experience and education, many try to enter the formal sector. This can explain why the informality rate drops for individuals who are 25 and up. Throughout the years, Brazil faced many different types of labor reforms. These reforms were mainly geared to the employees, and provided more job security for them. This put a burden on the employers when it came to letting individuals go. They had to provide just cause for why that individual was let go, provide them with compensation, and would often have to go to court to prove their case if the individual had decided to take them there. This can be seen as a major deterrent to companies that are looking to move or expand operations in Brazil. A trend though that can be seen as an advantage for companies to move to Brazil, is the transition from their current economy to a more educated economy. More skilled workers will be readily available, and companies will no longer have to search long and hard to find qualified candidates. The years of schooling for individuals has steadily gone up from the mid 90s to the present. Having a skilled workforce will attract many companies to Brazil on that reason alone. Also the development of many clusters within Brazil that are tied to several different Universities will help make education more of a priority for many of the locals.

Intellectual Property Rights

Protecting intellectual property rights is still a main concern with foreign companies coming to Brazil. Although there have been major strides to be in line with other big trading nations, timing of completion is still a major issue. Many more people in Brazil are noticing the need for intellectual-property law, and the government has even set up an appeals court in Rio to handle such cases. Also many laws have been passed regarding patents, copyrights, and trademarks, to help protect both domestic and foreign companies. Still with this new found understanding of the need for these laws, the time it takes for a company to be granted a patent and trademark, still takes a very long time. During this time, there has also been a cultural change happening as well. Brazil and its companies are now realizing that it is more essential to protect their intellectual property, than just protect themselves as a whole from foreign industry. Brazilians see that doing this will help promote innovation, and more foreign investment. This change in cultural thinking will help more companies look at Brazil as a place to move or expand their operations.

Recommendations

- One recommendation on supporting cluster competiveness is to simplify the Brazilian Tax Structure. Its complexity is a major deterrent for many foreign and domestic companies. Not only is the federal complicated, but the rules on the state level change from state to state.

- Brazil needs to stay with their big educational push. The emergence of a more skilled workforce will attract many more companies to Brazil.

- Brazil needs to find a way to expedite the patent and trademark process. This will allow more collaboration between foreign and domestic corporations, which will lead to much more innovation.

Local Policies Affecting Rivalry

Openness to Trade and Foreign Investment

Historically Brazil has used high tariffs to discourage trade and protect domestic industry, as well as maintain a positive balance of trade. During the early 1960s the tariff system was structured with regards to the Brazilian government's development objectives and domestic industries' requests for protection. Some of these tariffs completely eliminated foreign products from the market. When the military seized power in 1964, they reduced tariffs; however, when oil prices rose Brazil found itself with an unprecedented deficit. To restore the trade balance imports were greatly restricted. Brazil's move toward a more open trade policy began in with the Bresser Plan in 1987. In addition to small currency devaluations to check inflation the Bresser Plan relaxed tariffs, slightly reduced the rates and simplified the tariff system. Significant reforms were not made until 1991 when Brazil deemphasized administrative control of tariffs in favor of the published rates, simplified the import licensing procedure and began to gradually implement a series of significant tariff reductions. As a result of the tariff reduction program the simple average tariff fell from 50.6 % to 14.2% in 1993. Since these reductions the tariff rates have remained less than 20%. While Brazil has become more open to trade over the past two decades it still remains fairly closed and inward focus. During our company visits in Salvador and Rio de Janeiro only one company, ZCR Informatica seemed to be interested in engaging in international trade, the others were focused more on the local markets. And even ZCR trade goals were modest, their only market is Angola, in which Brazilian companies have a large competitive advantage due to their shared language and similar cultures. A comparison of tariff rates between Brazil and other developing and industrial economies also demonstrates Brazil's tendency toward economic isolation. According to the World Bank's tariff data from 2011 Brazil had the tenth highest tariffs of the 111 nations with current tariff data. Brazil's 14.1% rate is significantly higher than the EU member countries rate of 1.4%, the United States' 2.9% or China's rate at 7.9%. The levels of foreign investment in Brazil are considerable. In 2011 the amount of foreign investment in Brazil was 2.9% of their GDP. This is comparable to the rates in Russia and China. Other industrial nations, such as India and the United States have slightly lower rates of foreign investment. While foreign investment is not a significant portion of Brazil's GDP, Brazil is one of the main destinations for foreign investment money. In 2011 there was a net inflow of 71,538,657,409 US dollars in foreign investment. This placed Brazil as the fifth largest recipient of foreign investment, behind the United States, China, Belgium, and Hong Kong.

Licensing Rules

Brazil is one of the more difficult places in the world to start a business. The licensing and registration process to incorporate a new firm requires thirteen steps including but not limited to registering the business with the state's chamber of commerce, registering for state and federal taxes, applying to the municipality for an operations permit and creating a special fund for unemployment. Each of these different steps must be performed at a different location and/ or time. On average this process requires 119 days to complete. Out of 185 economies surveyed by Doing Business, Brazil's business licensing procedure was ranked 121, indicating that the process is nowhere near as easy and efficient a process as it could be. Despite the long registration process to create a business in Brazil entrepreneurship is gradually increasing. In 2004, 236,072 new businesses were created in Brail or 1.9 new businesses per 1,000 people of working age. By 2009 those numbers had increased to 315,645 new businesses, a density of 2.38 per 1,000 people. In order to encourage entrepreneurship and competition Brazil has recently made some improvements to the business licensing procedures. In 2010 the requirement to obtain a fire brigade license and inspection was eliminated and in 2011 the federal and state tax authorities began an increased electronic coordination. Another aspect of licensing is the licensing for import and export. Imports to Brazil require 8 documents per shipment, slightly more than the world average of 7.41. Similarly, Brazil requires 7 documents for exporting goods, while the world average is 6.5. Although Brazil's licensing rules for businesses are complex and time-consuming the processes are improving with a corresponding growth in entrepreneurship. With respect to licensing for imports and exports Brazil is right about average. While a comparison with other countries show there is probably room to streamline the process and eliminate documents Brazil's system is significantly better than some.

Anti-trust Policy

In May of 2012 Brazil's new Antitrust Law went into effect. One of the major new provisions of this law is that potentially problematic mergers must be approved before they are carried out. This increases the difficulty of creating an uncompetitive advantage for large companies. Under the old, post-merger approval system questionable mergers could be established and engage in business while under review. This caused reviewing procedures to drag in order for the participants to continue their business as long as possible. In addition the potential difficulties of undoing an already completed merger could make the examiners more likely to approve them, regardless of their effect on competition. A violation of Brazil's antitrust policy occurs when a company or group of companies working together can control or alter a significant portion of a market. The new Antitrust Law changed the definition of trusts with respect to the requirements of automatically filing for an antitrust review. Formerly any merger that would create a greater than 20% market share had to be approved by the Administrative Council for Economic Defense (CADE). Under the new law CADE approval is required when one business has revenues of more than 400 million reais and the other's revenues are more than 30 million reais. This change was implemented to reduce uncertainty since determining market is not necessarily an accurate process. The law declares that the penalties for violating the law should not be less than the benefits earned as a result of undermining competition when it is possible to determine such benefits. The officers of the company can be required to pay fines from 1 to 10% of the fines for the company, or from 50,000 reais to 2 million reais. In addition under Brazilian law cartel operators can be forced to pay to have an account of their crimes published in the newspaper. The new law creates similar legal standards for trusts to those in the United States and the European Union. It should also help reduce confusion and ensure that all participants have incentive for the approval process to run smoothly and effectively.

Influence of Corruption

In Brazil corruption is present at all levels of business. Although higher levels of corruption are being fought, there is a general perception that minor acts of corruption are acceptable and not really corrupt. Many employers will reimburse there employees for lunch expenses on the basis of receipts. However the amount on the receipt is often more than the value of the meal. The employee gets to pocket a little extra cash, the waiters get a tip and the company is just paying what they offered. The general attitude is that if no one is really hurt it is not corrupt and it is perfectly acceptable. A similar attitude prevails for expedited service and bribes to escape speeding tickets, people do not view these minor instances of corruption as a problem. According to Transparency International the best assessment of a country's level of corruption is the population's perception of the corruption. Other measures, such as scandals or investigations show more about the freedom of the press and effectiveness of law enforcement than the amount of corruption present in a system. Overall on the Corruption Perception Index, Brazil of ranked 73rd, with a score of 3.8 out of 10, indicating a high level of corruption. The organizations viewed as the most corrupt are the parliament and political parties. While businesses are viewed as moderately corrupt they are not the worst offenders. This fairly high level of corruption hurts Brazil's ability to trade abroad. In order to improve their international trade position Brazil has been pursuing reforms but, up to this point they have been limited to a small number of companies. As a result Brazilian companies are viewed as some of the most corrupt when doing business abroad.

Recommendations

In order to improve competition in Brazil international trade should be more strongly promoted through a reduction in tariffs and the formation of new businesses should be facilitated through a simpler and quicker licensing procedure. While Brazil has reduced tariffs from their highly protective stance in the 1970s and 1980s, tariffs remain much higher than other major economies. This is a barrier to foreign trade and a disincentive to businesses who wish to sell goods in Brazil. The current tariffs could probably be reduced by at least half, to around 7%. While this would not totally eliminate the protection offered to domestic business it would still provide revenue and would encourage foreign participation in the economy due to the reduced trade barriers. While reducing tariffs would increase competition by encouraging foreign companies to participate in the Brazilian economy, simplifying and speeding up the business licensing procedures would encourage entrepreneurship and promote local competition. Currently registering a business takes a significant part of a year and requires visits to multiple agencies. Creating a one stop shop where all of the paperwork can be completed at once would make creating a business much simpler. This could be an online portal such as that used by Canada and New Zealand. Currently the most time consuming part of starting a business in Brazil is applying for an operations permit from the municipality which takes 90 days. Eliminating or modifying this step could greatly reduce the time required to get a new business up and running and encourage people to try starting their own businesses, adding more competition to the economy.

Current Status of Company Rivalry in Salvador and Rio

Our research shows that while historically Brazil’s economic and political climate have not been the most conductive to promoting rivalry and competition recent changes exhibit a recognition of the need for reform and desire to promote investment and competition. During our visit to Salvador and Rio de Janeiro we did not see many signs of vigorous rivalry, however Technology Park is still very new. Despite this the environment seems to support sustained investment and promote the creation and growth of companies, which will enable local competition.

Of the companies we visited in Salvador there didn’t seem to be any strong competition between them. The most competitive companies we saw were Senetek and Imago, and even this was fairly limited. While both Senetek and Imago design medical devices Senetek is a large and well-established company that is generally hired by other large companies for large-scale projects. Imago, on the other hand is a small company, and its customers are generally small companies with a moderate budget. Due to their difference in scale Senetek and Imago don’t directly compete much for clients. However as Imago grows it may start to challenge Senetek’s position, and if other companies are created they will provide Imago with competition.

Salvador and Technology Park seem to be aware that currently the cluster does not have strong rivalries and have been pursuing policies that lower barriers to company formation and expansion and promoting investment in education to support innovation. At Technology Park tax breaks and opportunities to become a permanent part of encourage expansion and investment. In addition incubator programs help entrepreneurs create successful businesses and expand the possibilities for competition. In addition education programs are increasingly expanded and made more accessible in order to provided skilled workers that can drive innovation to Salvador’s industry.

While visiting many of the companies from Salvador, it is noticeable that the tax structure is very complex. At the Technology Park of Bahia, the presenters kept making it a point that when companies come into the park they are able to many different kinds of tax breaks. They said this will help many up and coming companies take care of the tax burden that they would see elsewhere. Some of the tax breaks that are offered by joining the Technology Park are an exemption on the real estate tax, a reduction of Brazil’s services tax (ISS) to 2%, and also a reduction to 2% on the services tax for the construction of their building. It has become clear that Brazil has a very complex tax structure, and these tax breaks will help to bring more companies to the Technology Park. Having more companies coming into the park will help create more healthy competition between companies, and help drive the need for innovation.

Although much of the information technology in Brazil is centered in Rio de Janeiro and Sao Paulo, the recently created Bahia Technology Park has the potential to make Salvador an important research and technology reference point in Brazil. With an investment of over R$47, the park is home to companies like IBM, Ericsson, Petrobras, in additional to providing research facilities for universities in Bahia. However the investment in Technology Park is not just by the government. As part of the third stage of the creation of Technology Park lots have been sold to companies for development. At the time of our visit 54 of the 63 lots had been sold. This demonstrates a large scale and long-term investment in the Park and innovation and research, especially by companies such as Petrobras and the Federal University of Bahia that bought multiple lots.

Efforts to expand competition and rivalry in Salvador are not limited to just promoting investment and expansion by well-established companies. Programs such as the incubator at Technology Park help entrepreneurs navigate the challenges of starting a business and expand the range of competition. As we’ve seen from visiting businesses and universities in Rio and Salvador, a lot of investment is being made in research and education programs to encourage innovation and develop a skilled workforce and incubators have been created to promote entrepreneurship. The Genesis Institute at PUC-Rio transfers knowledge from the university to help startups through the all the stages of the business development process. In the last twelve years, this has lead to the success of over 130 businesses, which created several thousand jobs.

Competition alone cannot drive innovation; skilled workers that can create and implement new ideas are also required. Salvador seems to recognize this and there is a push to provide young people with access to a proper education. The educational institutions that we visited showed the new ways the Brazilian government is trying to obtain this goal. Senai Cimatec had very good programs set up to get their students ready to enter the workforce. PUC Rio’s incubator set-up is a great way for students who are interested in owning their own business and apply what they have learned in school, to start their own company. With the guidance of instructors, they are able to get their own businesses off the ground and running. This new focus on education will help to employ many more skilled workers. There higher numbers of skilled workers will attract many more foreign businesses to look at Brazil as a place to expand their operations to. This will also allow many Brazilian companies to expand their operations, and have skilled workers to employ. In return to employ more people, companies will reap the benefits of people having more money and purchasing their products or services. This will be a major point in the growth of the Brazilian economy.

Factor Input Conditions

What are factor conditions?

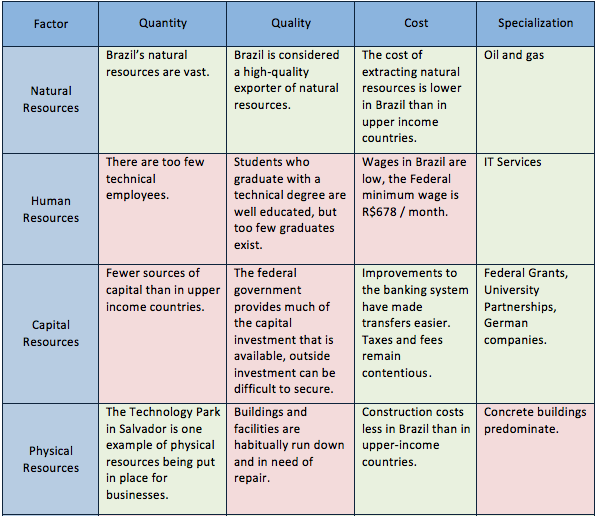

The factor conditions, or 'inputs', are the resources that companies draw upon in competition. Factor conditions will allow some companies to achieve a competitive advantage over others . There are seven key conditions, according to Michael Porter, professor at the Harvard School of Business, and these are natural resources, human resources, capital resources, physical resources, administrative resources, information infrastructure, and scientific and technological infrastructure. The quantity, quality, cost, and specialization of these conditions create a critical effect on business.

What Competitive Advantages Exist in Brazil's IT Sector?

Natural Resources

Brazil has a large amount of natural resources ranging from coffee to oil. They are known to export very high quality natural resources. From our experiences with the IT Cluster, oil and gas seem to be areas where Brazil excels. Since Brazil is still developing in many parts of the country, the process and price for extracting natural resources tends to be cheaper. Much of the materials used in the Salvador Technological Park as well as the IT Industry come from the natural resources Brazil is abundant in. Using the natural resources in an effective manner will help put the IT Industry ahead of their competition. As the Technological Park in Salvador becomes even more successful, they can use these raw materials as a vital advantage in their business.

Petrobras is a global leader in energy that is based in Rio de Janeiro. We discussed this company on many of our meetings in Brazil. In the Bahia industry meeting we saw that oil and gas play a major role in their economy. There are 52,000 bpd produced and 7 million m3/day of gas produced according to the Bahia economy. Petrobras is investing in 127.5 billion US dollars in oil and gas production in the future.

Salvador is a city that is fighting poverty and struggling to become more stable. We see the IT Cluster and many areas in the state of Bahia using natural resources to help promote a more stable economy, whereas Rio is a much more stable city. There are many poor parts as well, but the majority of the area is wealthy. Rio has more money to extract and use natural resources compared to Salvador.

Human Resources

Brazil’s human resources have been booming over the recent years. These resources are extremely important in Brazil’s economy since it influences business production throughout the country. Brazil’s labor market has reported the unemployment rate to be strong at 5.8%, right next to the all time low of 5.6%. Companies continue to hire employees, increasing 0.1% of employment each month. Although, Brazil has created labor laws pertaining to scheduling all employees for up to 8 hours a day and 44 hours a week. With this, employees can expand their working hours as long as it is agreed upon. Brazil’s wages are in the all time low, were the minimum wage is R$678 per month. Also, Brazil has many benefit packages for employers, such as family events and work related social gatherings. Brazil is including more benefit packages as the employment market expands. However, Brazil has many issues regarding their employees. They found a lot of were subject to different drug and alcohol abuse while visiting the companies they worked for. Brazil has developed different drug and alcohol tests to decrease the amount of abuse in the work force. Overall, Brazil’s human resources have increased significantly and are expected to rise over the future years. Pertaining to the visits we took across Brazil, CIMATEC had major issues regarding human resources. Specifically, CIMATEC had a huge demand of engineers. With a private institute with public interest, the government gave a 1% payroll, which was a mandatory tax. Although, there were free technical costs, which then allowed CIMATEC to develop free classes. These classes focused on specific career opportunities, but they didn’t allow a degree to be formed. This allowed more students to gain technical experience, however, it also kept students from graduating with a technical degree. This became a notified problem regarding human resources throughout Brazil. Overall, Salvador and Rio de Janeiro had many similarities in human resources. Although, Rio had developed more opportunities for students to graduate with a technological degree because of the different programs students can attend to build their own business. Rio also had more money and government funding in order to give out more opportunities to students.

Capital Resources

Brazil has the strongest economy in Latin America and is a country with an abundance of natural wealth and resources. Yet, despite its role as an industrial and economic power, the country suffers from extreme poverty. Its attempts at improvements in income distribution have yet to correct the problem of income disparity and social segregation. These social problems have affected many different aspects of Brazil’s economy. For example, there are fewer sources of capital compared to other middle income countries, due to the countries income disparity. Many industries have to rely heavily on the federal government, which provides much of the capital investment that is available - being that outside investment can be difficult to secure. The problem with relying on federal funds is that as of 2012 75% of Brazil’s revenue went to a fixed budget. This fixed budget means that the government uses its own discretion when choosing which industries will receive resources and funds. In short, even if there are funds and resources available, they are not easily available to startup industries. If these industries can secure a federal grant they must adhere to strict guidelines set forth by both local and national government. Luckily, improvements to the banking systems have been made easier to transfer funds but the taxes and fees associated with operating an industry in Brazil are controversial.

Physical Resource

The Technology Park in Salvador is the most prime example of how physical resources are being built for businesses, but most importantly the IT Industry. It is on 581,00 sq meters of land, and they are planning to continue expanding the park. Since they are located on such a large amount of land they made a point of preserving 150,000 sq meters of Forest. The Technology Park is one of the newest buildings we saw, as many of the buildings throughout Salvador are deteriorating and in need of updates. This is typically easy to do because many things are cheaper in Brazil, like construction. Most of the buildings are made out of concrete as well. The Technology Park was one of the most modern buildings we saw in Salvador. The location of the Park is on a very accessible road, which makes it easier to have relationships with their partners. The Bahia government plays a huge role in the physical resources of the state Bahia; they and their partners have done an excellent job of putting the Technology Park in motion. The building was built on modern functionality. There is the TechnoCenter, which is quite large and was built in 2012. It is intended to help give home to research and serve as the main administration. Many companies have bought land in the park with the intention of building their own property. While they are in transition they are able to have offices in the TechnoCenter until moving into their new construction. Not only are the companies buying land, many universities have decided to sign on as members of the park. As we can see, this has become a very up and coming industry and the park is just one element that goes into the IT Industry in Brazil. When looking at the physical resources in Rio de Janeiro, there is much more constant stability than Salvador. Salvador is still developing, whereas most of Rio has gone through the stages to become stable. The universities visited in Rio supported our concluding ideas that it is cheaper to build up in Brazil and most of the buildings are made out of concrete. With the continual booming of the IT Industry, Brazil is using every resource available to keep up with the constant updates. Having the best physical resources available allows for companies to be a part of the ever-changing IT industry.

Administrative Resources

Brazil’s administrative resources consist of five fundamental principals, sovereignty, citizenship, dignity of human beings, social values of labor and freedom, and political pluralism. Brazil’s states are required to collect their own taxes and then receive taxes collected by the Federal government. Also, Brazilian states don’t have the authority to create their own laws. Their criminal and civil laws are only voted by the federal Congress and then performed throughout Brazil. The administrative reform created in Brazil focuses on strengthening the market and social activities within the states, increase administrative capacity in the states, and conforming the fiscal adjustment. Although, when is comes to location of professionals most thrive in Sao Paolo because of the opportunities and focus of technology in Sao Paolo. Students coming from a college background have more of a chance to form into professionals then those that don’t. It is easier for technical students to form a business within technology because the cost of labor is low. Administrative resources within Salvador and Rio de Janeiro are relatively similar and get most of their resources from Sao Paolo. The productions in Sao Paolo allow for labor costs to stay low in Salvador and Rio de Janeiro. Overall, Sao Paolo is the main production maker of Rio de Janeiro and Salvador’s success within administrative resources.

Information Infrastructure

The information flow of the Salvador Technological Park is limited being that it is still in the beginning phases. The administrative infrastructure of the park is still being experimented with as the park itself grows. It has been stated that one of the main duties of the park’s administration will be to help promote information interchange and support between affiliates. In theory, the role of administration will be to provide a means of bridging the communication gaps between the government, firms, research institutes, and universities. Many of the concepts being fostered at the Salvador Technological Park are being used as a means of competitive advantage in Brazil’s IT sector. Much of the information infrastructure in Brazil is located in the megacity of São Paulo as well as the Federal Offices located within each state. The quality of information infrastructure has improved greatly as more IT companies are joining the country’s incubators, such as the Technological Park in Salvador. Over the last few years, open source technologies for word processing and databases have improved quality and consistency of the work of these companies. With another competitive advantage in Brazil’s IT sector being that their information infrastructure is less expensive to operate than higher income nations. Due to the competitive advantages of informational infrastructure, Brazil is able to use growing IT partnerships to help customize open source technologies.

Scientific and Technological Infranstructure

Computer hardware, computer software, and telecommunications form the backbone of scientific and technical infrastructure in IT. These are the tools used to build IT products, systems, and industries. According to data from The World Bank, internet access, personal computer ownership, and cellular subscriptions have been rising in Brazil. This fact is often cited by people working in technology as a sign of Brazil’s potential. With this infrastructure, they say, the country is ready for investment. The idea is that because more Brazilians are purchasing personal computing technologies, the country’s telecommunications infrastructure is expanding into the home and becoming integrated with people’s lives. This expanded infrastructure can be used to implement wide-scale technological products and applications. In Brazil, the IT sector may specialize in cellular applications. Cellular subscriptions are growing faster than personal computer ownership and IT researchers and developers are encouraging students to pursue software development and soliciting funding to strengthen the sector. Generally, prices are lower in Brazil than in upper-income countries. This is not always the case with IT, however. Dell computers, for example, can cost twice as much in Brazil as in the United States. The range of products available in Brazil’s malls and shopping centers is also limited. In Salvador, for example, the array of Apple products was limited to accessories and PC products were limited to a handful of items. Lastly, quality can be compromised. Cellular service, for example, although becoming more common, can be intermittent making Custo Brazil6, or, the cost of business in Brazil an issue for business and an inhibitor to growth.

Demand Conditions

Introduction

Brazil’s consumer culture is one of the most unique in the world. As national and international companies direct their marketing and sales efforts to the Brazilian market, it is imperative they recognize the need for innovative marketing efforts, the importance of recognizing diversity in the market, and communicate efforts to support the environment. The following is information is aimed to help companies selling in Bahia understand if there is market demand for their product or service.

Cautious Spending

The spending habits of Brazilians and companies are very much reflective of short-term thinking. Although Brazil has the seventh largest economy in the world, “consumer behavior doesn’t reflect that” (6). This short-term thinking is in part driven by a history of inflation and high interest rates, which has limited the spending power of consumers (1). In effect, this low purchase power has resulted in Brazilian companies and startups looking for foreign demand to sell their products. In order for companies to compete successfully on a global scale, innovation must be a key focus.

Bahia

It is important to note that this short-term thinking is driven by large economic discrepancies between classes. One issue we saw in Bahia is that the middle class is quite small; it seems individuals living in Salvador either have money or they do not. We can recall the size of the street market in Bahia. The majority of the goods sold there were simple items aimed at the lower class. These things included clothes, accessories, and food. In addition, we were encouraged to bargain, something that is very uncommon in the United States. As such, it is important for companies to understand that many Brazilians do not yet have smart phones nor do they pay attention to technology as much as consumers in more developed countries. At the moment, there is not yet a need for such items. However, the younger generations are paying much closer attention to the innovations happening abroad.

Innovation

What makes Brazil’s demand conditions unique is that its large domestic market is very economically diverse. Over 21% of Brazilians live below the poverty line, the largest number in the Western Hemisphere (7). As a result, in order to successfully sell their products, companies must focus on the consumers capable of buying those products. When considering that Brazil has the seventh largest economy in the world, it becomes apparent that there are many companies, foreign and domestic, selling to this increasingly significant market. This has resulted in ingenious marketing and advertising strategies. Examples include “in-store wine cellars and extended services, from in-store beauty and gastronomy consultants to food and photo printing kiosks, or extended warranties to mobile recharges and flash promotions at cash registers” (8).

The intense degree of competitiveness also sheds light on how companies can sell to countries whose consumers are moving above the poverty line. Brazil is a great example of a specialized segment of consumers that are steadily migrating from poverty levels into consumer levels (2,8). As other large developing countries such as India and China increase in its consumer levels, Brazil’s demand for innovative products can offer critical insights into fundamentally important aspects of both marketing and advertising.

Bahia

When visiting Bahia, it was clear there is not nearly as much demand for consumer technology products as in Sao Paulo, for example. Much of Bahia’s consumer goods were very primitive, and focused on fashion, culture, and food. If a company wants to sell products in Bahia, it must recognize that innovation is appropriate in the aforementioned industries. The newest iPhone, although appealing to younger generations, would carry a price tag that is simply out of reach for most of Bahia’s residents.

The Technology Park in Bahia offers a plethora of opportunities to innovate. Bahia’s technology industry is continuing to grow, Technology Park being a fantastic example. These types of clusters provide an excellent guidepost for individuals interested in selling to Bahia. Following in the footsteps of Silicon Valley, it is becoming clear that demand for IT innovation is growing. The companies that we were fortunate to meet did say that their demand was local. Some of the demand came from Sao Paulo. However, they clearly expressed interest in tapping into the huge demand abroad, in countries like the United States.

Environmental Support

Brazilian consumers also demand that the companies they buy from respect basic environmental rules. According to recent panels in the World Economic Forum in Davos, Brazilian consumers are more demanding than their European counterparts in how products are manufactured and disposed of. The drastic deforestation of the Brazilian rainforest, also known as the Amazon Rainforest, has resulted in a lot of awareness about environmental issues (3). To avoid risking rejection from local Brazilian markets, companies have to consider eco-friendly products, minimal packaging, and altered product formulas. This demand provides great insight into how developing countries may approach environmental issues.

One of the most striking demand features about Brazil’s environmental movement has to do with the integration of environmental and social movements. A unique aspect is the degree to which “environmental protection is interwoven with the theme of social development (reducing poverty, inequality, and injustice)” (4). It is evident that both issues are important to the Brazilian market, and it is likely the trend will continue throughout the globalization movement. This “strategic alliance” among environmental groups and “extractivist organizations, labor groups, and other related interests” (4) provides great insight into how companies must respect market demand in developing countries. It is important to recognize the slower pace of life in Brazil. Americans are often “on the go”, checking cell phones and emails every few minutes. Brazilians, on the other hand, operate at a much slower pace and do not yet require the gadgets on which more developed countries, the United States being one example, now depend. They make efforts to consciously protect their natural resources and beautiful surroundings.

Rio de Janeiro

One great example of this is simply the amount of forestation present in Rio de Janeiro. Being such a large metropolitan area, one that continues to expand, it was fascinating to see just how many trees there were. In the downtown area, it was clear that trees were left alone whenever possible, forcing pedestrians to walk around those left standing in the middle of sidewalks. It was fantastic to see; it defined the city as the tropical haven that it was. It is also important to acknowledge the slower pace of life in both Rio and Bahia. Most Brazilians do not subscribe to the “on the go” mentality, checking cell phones and emails every few minutes; few require to do so. Instead, the majority of Brazilians operate at a much slower pace and do not need the gadgets on which more developed countries, the United States being one example, now depend. In Bahia, it was clear that on weekends, crowds of people spend their day on the beach. People were relaxing and enjoying the year-round tropical weather. In other words, Bahia’s beaches and resorts are part of its tropical culture. As such, efforts to protect their natural resources and beautiful surroundings are very important. Companies selling in Bahia must recognize that Brazilians do not take lightly abuses of environmental issues.

Conclusion

It is clear opportunities abound in the Brazilian marketplace. Although Brazilians living in Bahia and Rio de Janeiro can be cautious about investing their time and money, they respond favorably to innovative thinking and support for social and environmental efforts. Brazil is a fantastic place to experience. More importantly it is an important frontier to understand in today’s ever-expanding global environment.

Related and Supporting Industries

A very important aspect of a cluster’s success lies in the related and supporting industries. Dr. Michael Porter describes the importance of several key factors in this section of the cluster’s framework. These factors are the presence of capable locally based suppliers, the presence of competitive related industries, and the establishment of a cluster-based trade association and financing. In this section, each factor is discussed and explained as it pertains to the current situation in Brazil (specifically, Rio and Salvador). The majority of the research focuses on the current situation in the two cities mentioned – extending the research to the rest of Brazil was not done intentionally as it would detract from the focus of the study abroad trip.

Presence of Capable Locally Based Suppliers

Suppliers can have many meanings. It can refer to: corporations (ie: Petrobras), government, utility/infrastructure organizations (such as EDF for lighting/electricity), universities, or even freelancers. All of these organizations have the potential to “supply” professionals with various things – be it skills, training, education, experience, or physical items. With this concept in mind, one can begin looking at the various suppliers that are present in Salvador and Rio and their influence on the cluster based paradigm.

One type of local based supplier is the joint venture. This is used to establish local capability in essential supporting industries. One clear example of this is the State of Bahia’s partnerships with banks and their joint system to pay taxes. This is done using an e-payment system. The partnership is continuing since the development of a complete e-services portal is under way. Another important example is TOPOS (a system incorporated with GIS technology) that is overlaid with Google Maps to help in the management of city and state projects. A final example is Indra, who with their involvement in tele-surgery and the corresponding technology, allows for locally based coloration to improve medical services. Based in Salvador’s emerging Technology Park, ZCR Informatica takes part in a knowledge sharing program that has great potential in helping businesses succeed and decrease overall costs for research and development (by preventing duplicate research).

Besides joint ventures, consortiums are an option in both Rio and Salvador. An excellent example of this is BOC (also within the Technology Park). While locally based, BOC is a group of eight companies that have an interest in Angola and progressing their business there. Through this international experience, BOC hopes to be able to compete on a global level – a very important factor in an increasingly competitive global marketplace. BOC also hopes to use their experience in Angola (being historically similar to Brazil) to help expand business locally in Salvador and Rio.

SENAI Cimatec (in Bahia) is involved in the recruiting, training, education, professional services and research/development in the IT field. It is considered a “private” institute, but receives public support (in the form of a 1% payroll tax). However, this is offset but the free courses it offers to the public with the hope of increasing the economy of the IT industry.

Presence of Competitive Related Industries

The IT industry is ever developing in Brazil, growing by 11% in 2011 alone. Following in the footsteps of California’s Silicon Valley, Campinas is the hotspot for technology. The hope of Salvador is to develop their Technology Park to create a competitive cluster similar to Campinas, and eventually, Silicon Valley. A positive early sign is the purchase of several lots within the Park by technology giant IBM.

However, despite the growth of the IT/technology field (and the cluster), other factors are stalling growth and competition. Increasing bureaucracy, brain drain (especially to Sao Paulo), and lack of international cooperation is dragging Brazilian IT businesses down. Several examples of “unnecessary innovation” exist. One prime example of this is based at CINAI Cimatec. The institute spends money developing the technology that is designed, manufactured, and tested at their facility by their technology workers (one example seen on the trip was the tablet for mentally challenged children). However, by the time this all occurs, the technology may be obsolete and money, time, and effort was spent without any real results. A solution may be to develop relations with international partners who either import or create local manufacturing to bring these technologies directly to Brazil. As logistical costs in Brazil are twice those in the USA, Brazilians may benefit from this type of arrangement. The Technology Park in Salvador is a huge step forward in terms of increasing innovation while hopefully reducing government involvement in day-to-day business.

Cimatec does have a positive contribution with its technical training program. Its international training program in Angola, Mozambique, and other African nations has been a success. Additionally, Cimatec has trained 132 professionals in Mexico in petrochemical operations. Hopefully, this can translate into increased business and jobs for Brazilians in the local economy when they are the ones being trained in operations. Other industries (many with ties back to Cimatec) that are competitive and contributing to the future of the cluster include naval construction, wind power, biotechnology, renewable energy research and offshore oil exploration & recovery (an area that Brazil is a global leader). Upcoming technology in fiber optics development will help improve IT infrastructure and help give cluster-linked businesses an advantage to conduct business faster and more efficiently. This research at Cimatec, lead by a PhD researcher with experience in the US, is an important step to help globalize the IT industry in Brazil.

Clusted Based Trade Associations and Financing

As previously mentioned, BOC is an important part of the Technology Park and extends to the success of the cluster paradigm in Salvador. An equally important organization in this respect is Assesspro Bahia. Assesspro Bahia is a trade association that is involved in the training and education of its members’ employees. Other organizations need to be created and work together to leverage their influence and help create competition and foster innovation. This is done by decreasing government involvement, reducing taxes, and opening up the marketplace to international investors.

Financing is a struggle in Brazil in general, with the government financing the majority of projects through a complex system of taxes, incentives, and bureaucracy. The establishment of venture capital firms, reducing government tariffs for international involvement and increased competition (similar to Silicon Valley) with help advance the cluster and promote substantial growth.

Brazil's Future Outlook and Potential Obstacles

IT in Brazil has a positive outlook if certain restrictions are removed or drastically changed.

1. Government involvement in nearly all financing (ie: very little international or venture capital funding). PUC-RIO Genesis Institute is a promising example based off US model of venture capitalism and entrepreneurship.

2. Tax reduction and simplification (this includes reduction in fraud and bureaucracy that stifles innovation).

3. Need to retain top talent in local areas (Bahia and Rio) after finishing university while also drawing international talent – in this respect, government incentives may be needed.

4. Increased enforcement of employment laws (corruption needs to be reduced drastically).

5. Need to address large disparity in extreme poverty and education and make high schools, universities, and trade schools available to more people (on a national level).

6. Increased use of public-private partnerships (like the Tech Park) to foster innovation and create sustainable businesses over the long-term.

The outlook is bright for Brazil, but only time will tell if they will be able to do what is necessary to continually grow their IT industry and become a substantial international player in this field.

|

|

|