Network Policy

Telecommunications Regulation: Stage 4

Panama has experienced many changes in telecommunication industry in past

fifteen years. The telecommunication

market was privatized in 1996 and de-regulated in 2003. The telecommunication

infrastructure has greatly improved as a result of investments made by Cable and

Wireless after privatization.

As a result of the de-regulation, new choices in telecommunication service

providers for national and international calls were made available.

Competitive rates offered by the new

providers have benefited both individuals and businesses. The National Public Services

Authority ("Autoridad Nacional de los Servicios Públicos" or "ASEP”), an

autonomous state agency, was setup to manage Panama telecommunication industry.

Key Dateline:

1996: The Panama government

began the process of privatization of the National Institute of

Telecommunications (INTEL).

1997: Prior to privatization,

INTEL was the sole provider of telecommunication services. In 1997, Cable and Wireless bought

49% of INTEL telecommunication services. The government owned the remaining 51%.

2003: The telecommunications

market was de-regulated and other companies were allowed to enter the market.

Cable and Wireless monopoly on national and international services ended with

emergence of new companies’ such as Telecarrier Inc., Clarocom, Advanced

Communications, Galaxy Communications Corp., System One World, Tricom, and Voip

Comunicaciones de Panama.

Panama – key telecom parameters – 2010

- 2011

|

Category

|

2010

|

2011

|

|

Fixed-line service

|

|

Total number of subscribers1

|

553,000

|

575,000

|

|

Teledensity1

|

15.4%

|

15.8%

|

|

Internet

|

|

Internet users (million)

|

1.50

|

1.65

|

|

Internet users penetration

|

41.8%

|

45.3%

|

|

Broadband

|

|

Total number of subscribers

|

276,000

|

320,000

|

|

Penetration rate

|

7.7%

|

8.8%

|

|

Mobile telephony subscribers

|

|

Total number of subscribers (million)

|

6.50

|

6.80

|

|

Mobile penetration rate

|

185.4%

|

187.2

|

Panama’s fixed-line

teledensity is well below the average, by about 3 percentage points, for Latin America and the Caribbean

countries.

Competition is also limited in

the broadband sector, where Cable & Wireless companies are not willing to

unbundle its local network and has secured a virtual monopoly in the delivery of

ADSL access. The only competition is across technologies such as from cable

modem and WiMAX services.

The mobile sector has been

flourishing with penetration well above the 100% milestone and about 30% higher

than the regional average. The arrival of new mobile providers around the start

of 2009 has resulted in high levels of promotional activity and steep price

reductions in mobile plans.

Internet penetration is

expected to grow further in 2012 as a result of Panama government’s ‘Internet

for All’ project. In 2010, Panama

became one of the first countries in the world to offer free wireless internet

access nationwide, reaching about 80% of the population. The National Internet

project does not compete with private Internet providers, because its aim is

digital inclusion and not the provision of high-speed access.

ICT Trade Policy: Stage 4

Panama’s government has worked to

liberalize the telecommunication, in accordance with the Information Technology

Agreement (ITA), which has given great opportunities to foreign companies,

especially the US, to invest in

telecommunication sectors. Panama’s

tariffs are already relatively low – an average of 7% for industrial goods and

around 15% for agricultural products.

“Panama maintains an essentially liberal trade

and investment regime, characterized by relatively low tariffs and few

non-tariff barriers, which is in consonance with the vital role that trade plays

in Panama’s economy” according to a WTO Secretariat report on the trade policies

and practices of Panama.

In October 2011, USA passed a

Free Trade Agreement with Panama and as a result of this agreement; Tariffs will

drop to 0% for U.S. Exports to Panama.

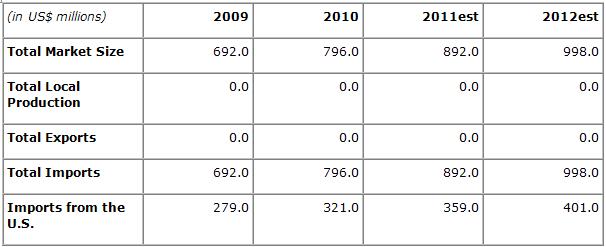

Market Estimates -

Telecommunications

Equipment - A Top U.S. Export Prospect for Panama

|