Nigerias readiness for the networked world has been over-hauled recently by the addition of a 7000 kilometers long submarine fiber optic cabling with a capacity of 1,920 Gbps to its existing SAT-3/WASC/SAFE. The SAT-3/WASC/SAFE cable basically links South and West African countries to Europe and Asia, and the new Main One cabling travels from Portugal along the west coast of Africa to Nigeria, Ghana and further extend to South Africa. This new undersea cabling, financed by Globacom, was completed and commissioned in April 2010, and it is expected to provide efficient access to the global communication network, thus Nigeria participation in the Network World is enhanced and established. Although this additional network infrastructure is in its embryonic state of deployment, its internal utilization will be examined to determine its immediate impact on network accessibility availability, and affordability to Nigerias approximately 149,229,090 consumers.

Information Infrastructure (Stage 3)

The primary gateway to information and telecommunications technologies in Nigeria is initially conveyed through SAT-3/WASC/SAFE and dispersed by Nitel (Nigerian Telecommunication Limited) the principal telecommunication company. Since its inception, Nitel has undergone through several changes that resulted in its 75% stake bought by Transcorp, a local company in 2006 and reclaimed by the Nigerian government in 2009, and recently acquired by the New Generations Telecommunication Consortium. This consortium included China Unicom (Hong Kong) Limited, Minerva groups of Dubai and a local company GiCell Wireless Limited.

In addition to Nitel gateway and information infrastructure, as mentioned earlier, a separate international 4,350 miles fiber optic submarine cabling from Portugal to Nigeria has been added in an effort to improve the global network access. This submarine cabling is expected to deliver faster and better broadband capacity than the South Atlantic Terminal (SAT-3) currently owned by Nitel. Beside these undersea cabling connections, communication technologies as such satellite communications including VSAT (Very Small Aperture Terminal), Microwave Transmission and GSM (Global System for Mobile Communication) are utilized to enhance global communications network access in Nigeria. The major players in Nigeria's telecommunication market include Globacom, a leading telecommunication provider that financed the new undersea cabling, MTN Nigeria, Zain Nigeria, Etisalat Nigeria, and Mtel. According to NCC (Nigerian Communications Commission) the market share of mobile operators as of June 2009 is as follow, Globacom 26.87%, MTN 46.19%, Etisalat 1.76%, Zain 24.74%, and Mtel 0.44%. The above market share tallies with the coverage per state or region, and collectively the services provided by these carriers, will eventually improve Internet availability and affordability, and further expansion coverage to the rural parts of the country, thus attempt to cater for the country's 149, 229,090 population. Therefore, Nigeria information infrastructure as of August 2010 is a stage 3, base on the CID framework guideline, because from the above report, a sizeable portion of the entire population has good access to the network world.

Internet Availability (Stage 3)

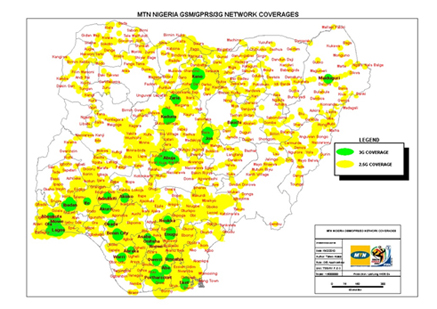

Nigeria's Internet access and availability is distributed by the ISPs across the different states and according to Internet World Stats "more than 400 ISPs have been licensed as well as number of data carriers, Internet exchange and gateway operators". Although information from the NCC website as of August 13, 2010 shows the five major carries as the only licensed companies, supposedly who have paid their license fees in full, it seems there are other providers not mentioned in the report. Therefore, beside these major providers, there are other carriers that contributed to the 23,982,200 Internet users as of December 2009, which is 16.1% of the entire population as documented by Internet World Stats. The range of services provided by these carriers varies depending on the geographical area covered, for example Etisalat Nigeria has distribution partners in the 27 cities, from Lagos in the south to Kano in the north. Globacom or Glo as it popularly known has coverage in all the states, thus with Globacom 10,000km of fiber-optic networking reaching out to the farthest part of Nigeria, Internet availability and connectivity is dispersed across the states. In addition to the above carriers, the following companies provides ISP services across the states, Visaphone Communications Limited, KKontech, Junistat, 21st Century, Cobranet, Tara System, Swift, IPNX, Mweb, NetCom, Cyberspace, Linkserve and Direct ON PC. Internet and Telecenters cafes in cities across the different states also provide additional Internet services; evidence of public access to the global network connection services. Below is a diagram showing MTN coverage, which practically coverage the entire country with 3G and 2G coverage spots.

MTN 3.5G Service Cover Area in Nigeria

Source: http://www.mtnonline.com/index.php/broadbandaccess.html

Nigeria's Internet available is a stage 3, on the CID framework, because based on this report as of August 2010; there is evidence of subscribers having some options between various Internet packages.

Internet Affordability (Stage 2)

Internet Affordability in Nigeria varies depending on the type of service provided. The average broadband service for an unlimited surfing per month is about N12000.00, which is equivalent to $80.00. Some ISP provide subscription plans in the following categories, Day Surfer with an allocated time slot which typically is between 8am-9pm, and on a particular network. A Nite Surfer, Pay as you browse, and an All timer Surfer; these packages have allocated timeslot and it is either unlimited or for a period of time. The average wireless Internet service for an unlimited surfing per month is about N10000.00 plus an average cost of N17000 ($113.00) for the USB modem. A typical package for a postpaid data plan is N10000.00 for unlimited usage for 3GB usage. These subscription plan and rates are for the average consumer; there are packages for corporation, including Blackberry services. From the above rates, Internet connectivity in Nigeria is costly, and with a population of approximately 149,229,090 million and limited services providers, it seems Internet affordability in the African nation is pretty stiff for the average Nigerian. Therefore, Nigeria Internet affordability is a stage 3 based on the CID framework, because although local network access exits, rates for ISPs service are high to discourage extensive Internet use.

Internet Speed and Quality (Stage 2)

Internet speed and quality in Nigeria varies depending on the ISP, for example Globacom, (Glo) offers bandwidth delivered over a 640 Gigabit backbone connection. This enables Glo to develop and provide Internet services with exceptional and uptime access speeds. On the corporate level, this provide corporations the opportunity to purchase wholesale Internet services and distribute this capacity into their network. MTN Nigeria, Data Leased Circuit package also provides businesses with a facility through which their data can be transmitted between computers and electronic information devices. This leased circuit according to MTN Nigeria, "offers flexibility of providing local (metropolitan) and long distance (inner city) circuits with speeds of n x 64kbps (Fractional links) to 2Mbps (E1) for high bandwidth requirement using a variety of media" to provide this services. Bandwidth-intensive activities also varies depending on the ISP, and although providers advertise "high speed rate", it appears that the major ISPs like Globacom with recent improvement in its connectivity infrastructure really deliver its advertised bandwidth. So in terms of reliability, it depends on the carrier and service package provided to consumers in a specific geographical location. So Nigeria Internet speed and quality is a stage 2 on the CID framework mainly because larger business and ISPs can link their network to a local infrastructure backbone.

Hardware and Software (Stage 2)

Although there are used and new computer retail shops in Nigeria, hardware and software affordability is a major obstacle to attain a fully network access environment. For example major computer vendors including HP Nigeria, and Dell Nigeria has supplies partners in Nigeria with computer prices close to the US market; which is expensive for the average Nigerian. In addition, a local computer manufacturing company Zinox Computers, which produced Nigeria's first internationally certified branded computers contributes to the computer market. And since its prices are moderate compared to the major competitors, it is favored but quality is an issue among its users. All the same, Zinox contributions have kept the computer market vibrant with numerous options, both used or new computers for Nigeria consumers with a per capita income of $2748 as reported by Nigeria's VANGUARD. In an effort to expand its product usability, Zinox in 2008 joined forces with a local telecom operator Reltel, to provide Nigerians with Internet-ready computers. These computers according to Zinox Chairman Leo-Stan Ekeh will at "discounted prices of 89, 500 naira (US$763), while Reltel contribution would be the provision of Internet access to buyers at the much subsidized rate of 10,000 naira per month". This initiative and Zinox local presence evidently adds to the number of computers in Nigeria, but with the over all computer average prices and Nigeria per capita income, it seems the current prices of hardware and software will stall the accomplishment of a fully networked society. Therefore, Nigeria hardware and software supply is a stage 2 on the CID framework; because from these findings it seems basic hardware and software are affordable for some citizens and small and medium-sized businesses.

Service and Support (Stage 2)

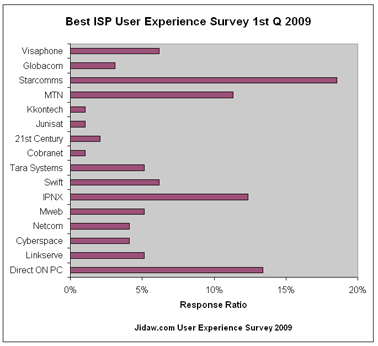

The major carriers in Nigeria have some form of support for customers with links on their websites, but as to how this support services are rendered is not easily determine. For example Globacom has a customer care center that functions twenty fours hours a day, seven days a week with an assurance of answering all questions on the phone. Visaphone has an online customer care link on its website, which permit customers to enter request and submit it. But there is no evidence of a support center dedicated for customer support. Etisalat also has a customer support link with several sub links and an online chat option for either voice services assistance and Internet Services assistance with "schedule a callback" link that permit customers to provide their name and phone and the time they will like customer support to call them back. Website link to MTN Nigeria customer care offers a customer complaint form and a Frequenlty asked questions option, with no evidence of direct support services. Although these options are attractive to the average consumer, evidence of successful service support and network deployment can be obtain through a survey of customer experiences. The following chart is a user experience survey conducted by Jidaw.com, which shows Nigerian Internet Service Providers ISP rating as at Q1 2009.

Source: http://www.jidaw.com/nigeria/nigeria_internet_service_providers_rating.htm

The above ISP ratings in Nigeria can be considered as evidence of customer service relations in deploying a reliability and supportive network access to consumers. This chart serve as evidence to the advertised customer care and support on the website of the different mentioned carriers as of 2009.