|

|

Networked Economy

Networked Economy

Germany

is part of the EU and an Industrial Power House

Germany

is part of the EU and an Industrial Power House

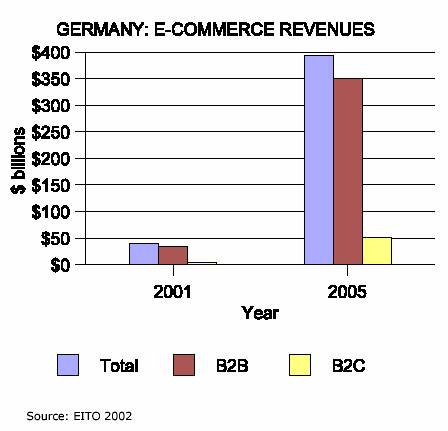

The EITO 2002 report valued Germany’s B2B e-commerce revenues at €39.7 billion

($34.9 billion) in 2001. B2B e-commerce use is growing as German firms realize it can boost their competitiveness, as younger, more IT-savvy Germans move into management positions, and as larger globally active German firms use e-commerce to interact with their disparate offices, partners, and suppliers.

B2B e-commerce

In Germany, business-to-consumer e-commerce is not very widespread. Business-to-business e-commerce is slightly more common. Both e-commerce segments are growing, however, and the German government is eager to see e-commerce take off to energize the economy and provide jobs in the face of high unemployment. EITO 2002 predicts that B2B revenues in Germany will rise 76.9 percent to reach €388.6 billion in 2005. Although approximately one third of Germany’s large companies already have implemented B2B e-commerce solutions, a 2001 survey by the German research and consulting firm Putz and Partner found that only one third had a strategy to drive their e-business investments. However, in 2001, large German firms began investing in e-business strategies, resulting in a growth in e-business strategy consulting. One industry representative claimed this has increased 200 %. Large German firms are investing in technologies that can augment their relationships with critical partners. As in the United States, many German firms are creating distinct, secure areas on their intranets/extranets for customers and distributors to track orders, stock management, and the like. However, firms are foregoing e-business technologies not deemed critical. For example, enterprise portals, common in the United States, are not as popular in Germany. Some German firms, such as auto dealers, have enterprise portals to interface with U.S. customers, but most German firms are reluctant to invest in these portals, citing lack of demand. Germans simply do not spend as much time looking up information on the Internet as Americans.

Challenges Facing B2B e-commerce

Although business-to-business e-commerce is more widely used in Germany than business-to-consumer e-commerce, its adoption is 18 months to two years behind that of the United States. This figure is up from three years behind U.S. adoption rates merely two years ago. Many large German companies’ web sites are static and do not provide interactivity with customers, suppliers, allow for electronic commerce, and approximately one third of German companies’purchasing departments don’t even have Internet access. In addition, Europe’s multiple languages mean that German firms who want to create economies of scale throughout the region in e-commerce, both B2B and B2C, will continue to face major challenges. Another challenge but not nearly as pronounced in B2B as in B2C, security concerns exist among German businesses regarding online transactions. Increasing use of electronic signatures is expected to help allay security concerns.

B2C

e-commerce:

B2C

e-commerce:

Germany’s 2001 Business-to-Consumer e-commerce revenues were €5.7 billion ($5.0 billion), according to EITO 2002. Germany leads the rest of Europe in B2C e-commerce use.Online stores are gaining in popularity, and the Hamburg-based retailer the Otto Group (which owns Spiegel catalogs) is the world’s second largest online retailer, based on sales figures, after Amazon. Currently, B2C ecommerce purchases in Germany are similar to those in the United States– the most common purchases are books, music, toys,

hardware and software, electronics, and travel-related services. However, compared to the United States, B2C e-commerce use in Germany remains limited. Germans have not yet warmed to Internet shopping. Many Germans reportedly do not see compelling reasons for purchasing online. One main factor limiting B2C e-commerce in Germany is low household Internet use. This is due to local phone charges, limited flat-rate

dial-up Internet access (both of which discourage browsing), and low home broadband penetration.

Challenges Facing B2C e-commerce

Security concerns, very prevalent among German consumers, are another major hurdle

to greater B2C e-commerce use. Many German consumers are uncomfortable with

the security of online transactions and the reliability of electronic payments.

Germans also are extremely sensitive about the protection of their personal data, and fear

its misuse by online merchants or others, much more so than U.S. consumers. Industry

participants interviewed in Germany report that German consumers seem not to be quite

as concerned about the protection of their personal data in the aftermath of the terrorist

attacks of September 11, 2001.