Quick Link Menu

Network World in Brazil

Network Access of Brazil

Information InfrastructureToday, information infrastructure plays a vital role in how countries interact and do business with each other. Studies have shown that developing countries with limited information infrastructure are less competitive in global markets. In recent years, Brazil has dominated South America and the Latin market to form a significant global presence.

Brazil’s Internet infrastructure began in 1987 when FAPESP and LNCC successfully exchanged TCP/IP data packets with American entities. In 1990 the RNP was formed to design and implement an Internet backbone for Brazil. RNP faced limited funding up until 1992 when it was asked to host the Eco-Summit which would require visiting journalist to be able to send data back to their respective countries.

Within the next five years, the Internet backbone rapidly expanded throughout the country giving access to most of the country’s academic and research facilities. In 1998, the company Embratel, which was responsible for the building of the Internet backbone, was bought by the US company MCI. This action helped expedite the growth of Brazil’s Internet and telecom infrastructure and single handedly made Brazil a dominant figure in the Latin market.

Brazilians have many options when it comes to connecting to the Internet. This is mostly due to the geographic locations of cities where multiple connections are considered. Services offered range from dial-up, ADSL, Broadband, and satellite. There are currently more than 500 different Internet access providers in Brazil, giving citizens an array of options when selecting a carrier.

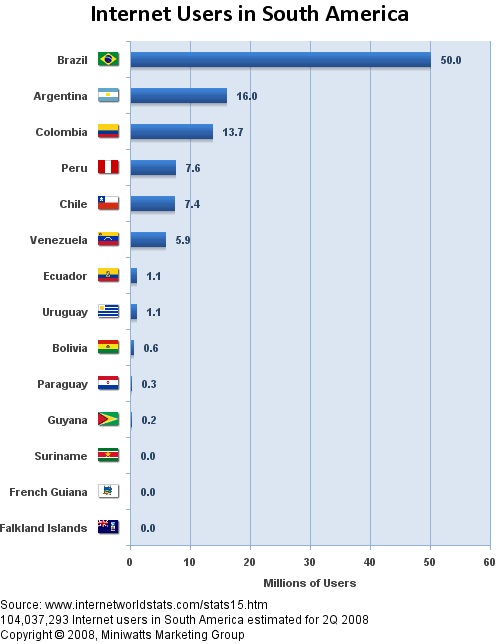

Brazil currently dominates the Latin market with around 50 million Internet users, which represents 26% of the country’s total population. Brazil has seen an incredible 900% use growth since the year 2000. This is largely due to the decline in computer prices and import taxes.

As of late, many of the poor have been able to access the Internet due to lowered prices of PCs and Internet access. Those who are still unable to afford computers or Internet access are now able to take advantage of thousands of cybercafés being built throughout the country. In 2007, cybercafés were the most popular places Brazilians visited to gain access to the Internet.

For the first time in 2008, there were more computers sold than TV sets. Low-income populations that were able to afford PCs and Internet access fueled this computer sales growth. The government also developed programs such as “Computers for Everyone” to help further assist the working poor with their first computer purchase.

In 2008, Brazil experienced a 17% increase in computer ownership of people who made between R$600 and R$1000 a month. Internet Services in Brazil vary in cost depending mostly on location and availability. Dial-up service is around R$30 a month, while ADSL and Broadband can range anywhere from R$90 to R$120 a month. Fortunately, these prices are constantly declining in the Latin market due to more readily available resources.

As hardware and service becomes more affordable in Brazil, many believe Internet access will help reduce crime in some the country’s most unforgiving areas. Viva Rio, a anti-violence organization located in Rio de Janeiro, runs a program focused on creating Internet access centers that offer IT courses and job listings for residents of local Favelas. The organization hopes that members of the local gangs will take interest in the program ultimately reducing violence in these deprived areas.

Network Speed and QualityBrazils on going efforts to be a competitive player in the IT market can be recognized with progressive endeavors by both the governmental and private sectors to enhance network communications. As of recent date the Brazilian broadband market is organized regionally which stemmed from the break-up of the former incumbent Telebras in 1998. Brasil Telecom (BrT) is the incumbent telecommunications operator in Brazil, offering fixed and mobile telephony, broadband Internet and free dial-up connection in 33 per cent of the country. Its operations are focused on central and southern Brazil. The five other concessionaires (Telemar, Telefonica, CTBC, Sercomtel and Embratel) and 21 authorized operators cover the rest of the country. In December 2005, Brazilian telecoms regulator Anatel signed new 20-year fixed-line concession contracts with Embratel, Telemar, Brazil Telecom, CTBC Telecom, Sercomtel and Telefonica for the provision of local and long-distance services.

The country has a wide-ranging fixed line network. In December 2005, the density of fixed lines in service stood at 21.5 per 100 inhabitants. The concessionaires had 84 percent installed accesses and 94 per cent accesses in service. However, the cable infrastructure is still limited to the main urban centers only. However discretionary projects have been outline amongst the incumbents to provide at bare minimum some type of broadband service to the rural areas or the country.

As the market for wired broadband in Brazil perpetually gains geographic market share, it is apparent that Brazil’s mobile phone market deems itself as a highly competitive market with about eight or more mobile operators fighting who are as follows: Vivo, Claro, TIM Brasil, Telemar Oi (with its 2008 acquisition Amazonia Celular), Telemig Celular, CTBC Telecom, Sercomtel Celular and Brazil Telecom. These operators, together with one trunking operator, left the 3G auctions empty-handed (Nextel Brasil) operate in different regions. Brazil’s newest mobile operator is Unicel, which went live in September 2008 in the Sao Paulo metropolitan area, offering services under the brand name Aeiou. Of the still nine mobile operators, four hold over 90 per cent of the national market.

It is estimated that Brazil holds about one third of all the mobile subscribers in Latin America, with mobile penetration still growing at a rapid pace. GSM is still the favored technology, with a 3G auction held by the regulator in December 2007. Operators have lost no time. Once they had secured 3G licenses and exchanged contracts with the regulator in April 2008, they immediately started regional deployments. In May 2008, BrT launched 3G services in region 2, while Oi did so in regions 1 and 3. TIM Brasil extended its 3G network using the 2100MHz band to launch UMTS services in Rio de Janeiro, Sao Paulo, and Brasilia. Claro followed, using the 2100MHz band.

A prime examples of network infrastructure advancements is how technology paves the way for a true revolution in the ability of lower income segments to access information, an essential component in Brazil's quest to speed up the pace of its race toward development. Similarly, once broadband has been made available in both public and private schools and universities throughout the country, it will turn bold educational projects, such as distance education, into a reality. With this in mind Brazil as of just recently embarks on what is to be Worlds Largest Desktop Virtualization Deployment - 356,800 Green PC workstations. As stated in the article: http://www.canadait.com/cfm/index.cfm?It=106&Id=26835&Se=0&Sv=&Lo=2

“This initiative will provide computer access to millions of children and adolescents throughout the country. It is a historical achievement, being: the world's largest ever virtual desktop deployment; the world's largest ever desktop Linux deployment, and a new record low-cost for PCs with the PC sharing hardware and software costing less than $50 per seat. The decision to deploy Userful and ThinNetworks' low-cost and environmentally friendly desktop virtualization solution establishes the Brazilian Ministry of Education as a global leader in computer education and provides other governments and institutions worldwide with a proven model for improving student to computer ratios while rolling out large numbers of desktops with minimal cost and environmental impact. “. ibid. (4)

The hardware developed and manufactured for the project is designed to work reliably in harsh conditions with little supporting infrastructure. Thousands of thin client stations have been successfully deployed in schools all over brazil in indigenous villages, where infrastructure is minimal, electricity is unreliable, and there is little physical space. By the end of 2009, the project will have benefited millions of young Brazilians. The conjunction of software and hardware companies like Multiplier and ThinNetworks who are the founders of this project make it possible for future endeavors just like this to become a reality.

Service and SupportAccording to recent surveys the rollout of broadband access can help bridge the "digital divide" that exists between Small to Medium Enterprises (SME’s) and large organizations. In Brazil, SMEs represent 98 percent of the total number of companies, and studies suggest that approximately 46 percent of their investments will be made to build the infrastructure for their data transmissions. A recent survey conducted by Siemens-Brazil of more than 3,000 companies in country has demonstrated that fewer than 10 percent of the SMEs polled use call center systems, although such systems can enable significant revenue gains by enhancing their relationships with their customers. A promising example of this is being implemented on the outskirt of Rio de Janeiro as a unified project endeavor of the city of Petropolis. The project is entitled ‘Petropolis- Technopolis.’ This endeavor can be considered to be a concentric movement to inform and create an environment for small to medium size enterprises such as Neki solutions, which is a open source applications development solutions and services provider, to render is services create partnerships to various cross platform solution providers as well as too SMEs that would need their services. The formulation of projects such as these can be considered one of the catalysts as to how brazil provides, renders and considers itself as a major IT service and solutions contributor to the regional and global IT markets.

01. http://portal.acm.org/citation.cfm?id=1186595.1186628

02. http://www.internetworldstats.com/sa/br.htm

03. http://en.wikipedia.org/wiki/Internet_in_Brazil

04. http://www.canadait.com/cfm/index.cfm? ...

05. http://www.austrade.gov.au/ICT-to-Brazil/default.aspx

06 http://www.brazil-it.com/archives/2007/10/brazilian_it_in.php

07. http://weblog.infoworld.com/realitycheck/archives/ ...

08. http://newsroom.cisco.com/dlls/2008/prod_030508b.html

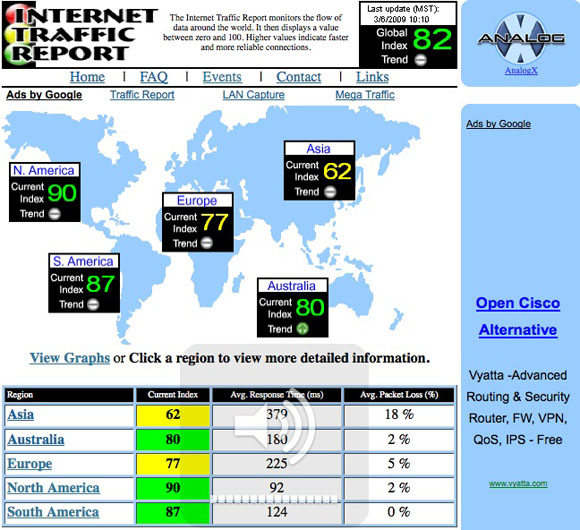

09. http://www.internettrafficreport.com/main.htm - graphs

10. http://www.ibls.com/internet_law_news_portal_view.aspx ...

11. http://www.internetworldstats.com/sa/br.htm

12. http://wks56.rjo.embratel.net.br/Embratel02/cda/portal/ ...

13. http://www.v-brazil.com/science/history-internet-brazil.html

14. http://www.brazil.org.uk/newsandmedia/pressreleases_files/ ...

15. http://www.icannwatch.org/articles/05/06/13/036210.shtml

16. https://www.cia.gov/library/publications/the-world-factbook/ ...