Network Access

Information Infrastructure (Stage 3)

Canada's technological capabilities are impressive, with over 98% of households having telephones, 28% having cell phones, and 51% having home computers and Internet access. Along with one of the fastest (40Gbs) Internet backbones in the world, this makes Canada one of the most technology-savvy and connected countries in the world. In 2000, the industry generated revenues in excess of $CDN 125 billion. Over the period from 1993 to 2000, this sector achieved a compounded annual growth rate of 9.9%, and employment showed increases of 5.7%. Canada has developed a vibrant information and communications technologies industry, with strong competitors in telecommunications, wireless, network and optical technologies, semiconductor design, and s! software development.

Internet Affordability: (Stage3/Stage3)

Cable operators and telecommunications services providers have invested substantially in infrastructure upgrades in order to be able to offer broadband services. Broadband access services have also been an important source of revenue growth for telecommunications services providers offering broadband over Digital Subscriber Line (DSL) facilities, cable operators, and other Internet service providers (ISPs) who derive the majority of their revenue from the sale of Internet access.

Many communities, located mostly in rural and remote areas, do not yet have broadband services available, due to the smaller customer base and higher costs associated with deploying infrastructure over long distances. A number of initiatives are underway in order to address broadband deployment in rural and remote communities.

Network Speed and Quality: (Stage 3)

Internet Availability: (Stage3/Stage4)

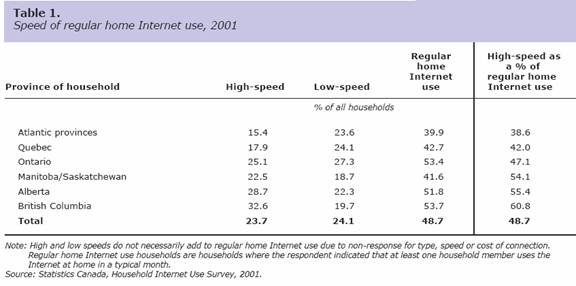

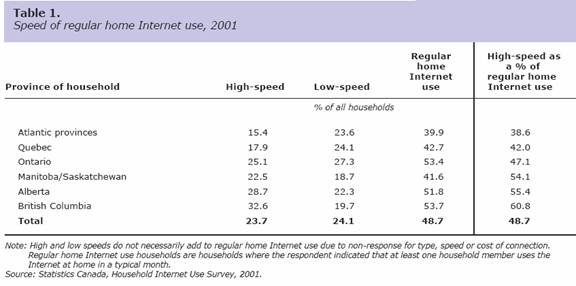

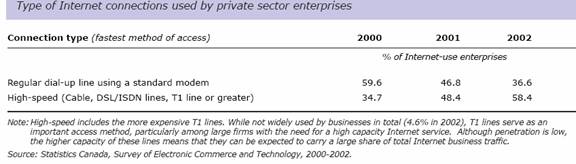

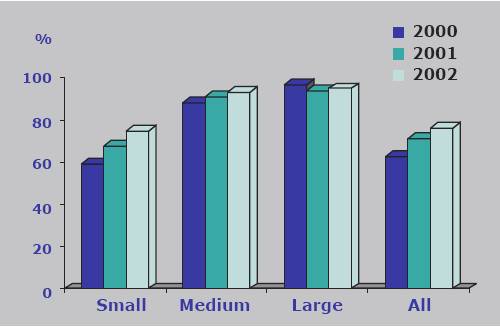

Canadians are among the world’s leaders in broadband use. Nearly half (49%) of all regular home Internet use households had a high-speed Internet connection in 2001. This proportion increased from east to west, with 61% of regular home Internet use households connecting using broadband in British Columbia, compared to 39% in the Atlantic provinces. For the private sector, 2002 marked the first year in which the majority (58%) of enterprises using the Internet connected using broadband technologies. The Information and Cultural Industries continued to be leaders in broadband penetration (86%). Analysis by enterprise size further revealed that broadband use was higher among large firms. Sixty-six percent of Canadian companies now have high speed (broadband) Internet, up from 48% in 2001. Small firms with high speed access accounted for 13% of online sales in Canada. Small firms were more likely to make purchases online in 2003 than they were a few years ago. Canada's technological infrastructure is second only to the U.S. among the G-7 — we rank above or very close to the U.S. in terms of :internet users and internet hosts computers per capita.

Building a universal, competitive, leading edge "Information Highway" is a government priority.

|

Technological Infrastructure* World Rank |

|

|

Country |

Rank |

|

U.S.A. |

1st |

|

Canada |

4th |

|

Japan |

9th |

|

Germany |

14th |

|

U.K. |

17th |

|

France |

19th |

|

Italy |

36th |

|

Source: World Competitiveness Yearbook, 2004 |

|

* Standing among 60 countries. Index based on 20 characteristics including investment in telecommunications, computers in use, computer power, internet connections, number of telephone lines, cost of telephone calls and use of robotics.

Canada's Internet Sales Posted Strong Gains

Internet sales in Canada continued to grow in 2003, up 40% from 2002 accounting for less than 1% of total operating revenues for private firms Private firms accounted for $18.6 billion of online sales (approximately 97% of total sales)

Internet Affordability: (Stage 3)

Cable operators and telecommunications services providers have invested substantially in infrastructure upgrades in order to be able to offer broadband services. Broadband access services have also been an important source of revenue growth for telecommunications services providers offering broadband over Digital Subscriber Line (DSL) facilities, cable operators, and other Internet service providers (ISPs) who derive the majority of their revenue from the sale of Internet access. Many communities, located mostly in rural and remote areas, do not yet have broadband services available, due to the smaller customer base and higher costs associated with deploying infrastructure over long distances. A number of initiatives are underway in order to address broadband deployment in rural and remote communities.

Connectedness

|

Connectedness Rankings 2003* Conference Board of Canada – 10 Country Comparison |

|||||

|

|

Overall

|

Availability |

Price |

Reach |

Usage |

| U.S. |

1 |

1 |

2 |

2 |

1 |

| Canada |

2 |

2 |

1 |

2 |

2 |

| Sweden |

2 |

3 |

2 |

1 |

3 |

| Finland |

4 |

4 |

5 |

5 |

5 |

| U.K. |

5 |

5 |

7 |

5 |

5 |

| Australia |

5 |

7 |

9 |

8 |

4 |

| Germany |

5 |

5 |

6 |

4 |

7 |

| Japan |

8 |

8 |

8 |

7 |

8 |

| France |

9 |

9 |

4 |

9 |

9 |

|

Italy |

10 |

10 |

10 |

10 |

10 |

|

Source: The Conference Board of Canada, April 2004 |

|||||

* The four components are defined as follows: (i) Availability is the supply, reflecting the potential to be connected. (ii) Reach is the demand. It refers to those people who already subscribe to the network. (iii) Use measures such factors as actual hours online, number of transactions and dollars of revenue generated on the internet. (iv) Price also comes into play in so far as it influences reach and

Wireless & Internet

Canada ranks first among the G-7 in terms of wireless communications costs and among leaders in terms of internet access charges.

|

Wireless Communication Costs, Price per minute, 1999 |

|

|

Country |

U.S. $ PPP |

|

Canada |

0.12 |

|

U.S. |

0.13 |

|

Italy |

0.21 |

|

France |

0.21 |

|

U.K. |

0.21 |

|

Japan |

0.30 |

|

Germany |

0.31 |

|

Source: Merrill Lynch, Wireless Matrix 3Q02, December 2002 |

|

Network Speed and Quality:

|

Speed of Internet Access (724 Participants) |

||

|

|

||

|

Dialup, 56.6 access (149) |

21% |

|

|

ISDN (21) |

3% |

|

|

Highspeed cable or DSL (513) |

71% |

|

|

Dedicated T1 Line (6) |

1% |

|

|

I do not have Internet access at home (35) |

5% |

|

http://www.rescol.ca/home/e/poll/result_page.asp?poll_id=205

Major Increase in High-Speed Internet Adoption

Both broadband access and online sales are concentrated in large private companies (more than 500 employees) 95% of large firms had high-speed Internet and accounted for 45% of online sales in 2003

Hardware and Support:

Since the first-ever wireless message across the Atlantic Ocean to Canada in 1901, the country has developed a vast communications and IT infrastructure, giving rise in recent years to global champions like Nortel, Research In Motion (creators of the acclaimed Blackberry technology), and Sierra Wireless. With more leaders emerging among the nation’s 32,000 ICT firms, and large R&D investments from Ericsson, Nokia, Motorola, and others, a rapidly growing network of innovation continues to develop in Canada.Information and communication technologies are a driving force behind Canada’s flourishing knowledge economy, achieving an average annual output growth of 9.2% between 1997 and 2003, over the national GDP average for the same period of 3.7%.

The following table illustrates the increasing use of computers at Statistics Canada, mirroring their growing use in the large business community.

Service and support: (Stage 3)

In virtually every area you can think of, Canadian software firms are world leaders. Here are four:

Multimedia

If you’ve seen films like Lord of the Rings, Gladiator or Titanic, you’ve experienced Canadian multimedia magic in action. Three of the films that were Oscar-nominated for best visual effects in 2002 used Canadian special-effects software from companies such as Alias| Wave front and Discreet — Lord of the Rings: The Fellowship of the Ring, AI: Artificial Intelligence and Pearl Harbor. In fact, according to wired magazine, Canada supplies 80 percent of the animation and special-effects software used in Hollywood. Security — global demand for security technologies has never been greater, and the many Canadian software firms active in the security field are ready to meet needs from biometrics, to encryption, to information technology (IT)-based inspection aids and firewalls. Canadian companies like Entrust, with 1200 clients in more than 40 countries, and Images, with 130 major biometric installations worldwide, are providing security solutions around the globe.

Business intelligence and Document Management

These are the keys to success for any company. With 50 offices around the world, Congas is the world’s second-largest business-intelligence firm, and Vancouver’s Crystal Decisions is number three. Five million users representing 90 percent of the Fortune 500 rely on Hummingbird software.

IT services

Provides the software and the infrastructure that make the high-tech world go round. Here, too, Canada is at the forefront, with world-class Canadian-founded companies like the Quebec-based CGI Group, employing more than 11 000 people around the globe, and X-Wave of Newfoundland and Labrador with2400 professionals in offices across Canada, the United States and Ireland.

Infrastructure

Canada's Internet Sales Posted Strong Gains

Internet sales in Canada continued to grow in 2003, up 40% from 2002 accounting for less than 1% of total operating revenues for private firms. Private firms accounted for $18.6 billion of online sales (approximately 97% of total sales)