Group Project

Networked Access

Information Infrastructure

The term 'information infrastructure' (II) refers to the communications networks and associated software that support interaction among people and organizations. The Internet is the phenomenon that has driven the debate to date. The term Information Infrastructure (II) is useful as a collective term for present networks (including the Internet, and the underlying long-distance and short-distance communications technologies) and likely future facilities. Nowadays, this field is a profitable business in the emerging countries like Brazil . Most of the companies in these countries invest a lot of money in this business to provide their clients with solutions that satisfy their desires. Among the companies that we investigate, many of them try to develop and ensure the quality of these solutions.

The Internet access services market in Brazil has featured enormous growth and continues to show a positive trend reflected in the highest number of Internet and broadband subscribers in the last years. This is mostly reflected in the following factors:

- An accelerated growth of DSL and cable modem subscribers

- Increasing competition in key-neighborhoods of the most important metropolitan areas

In 2004, the Brazilian broadband market was dominated by DSL and cable modem technologies. The broadband access market in Brazil has shown a development of new products, such as low-end, flexible and condominium plans, as well as value-added-services such as broadband content portals. The broadband access market in Brazil is expected to grow at a 17.4% compounded annual growth rate between 2004 and 2010. Revenues for broadband services are expected to grow from $412.5 million in 2003 to $2.143 billion in 2010

To meet the demand, many of the Brazilian started to develop solution for high performance communication like next generation networks. In today business, telecommunication is a significant factor in success and because of that, a lot of organization spent more than 20% of their IT budget to develop telecomm. One the solutions that some vendors provide is Telecom Expense Management where the enterprises can reduce there spending in telecomm. Enterprise network transformation, is another service that help enterprises reduce there spending by implementing new network technologies across the enterprise and identify where significant costs savings can be achieved.

One of the most recent technology that has been develop by a Brazilian company called network convergence and it provides communication solution for enterprises that have many and remote sites and branches. This technology integrates both VoIP and VoFR (voice over frame relay) into a single transmission media to build a corporate private network that is secure and reliable. There are many latest technologies that the Brazilian companies provide:

Virtual phone: allows the extensions to have all the functionalities of a digital telephone, as well as a range of additional features, including caller identification, teleconference, appointment reminders, and individual notepads per customer, personal phonebook and general phonebook.

TariFone : TariFone is an efficient management tool enabling cost monitoring at all levels and performance analysis of a private telephony system.

Internet Availability – Stage 3

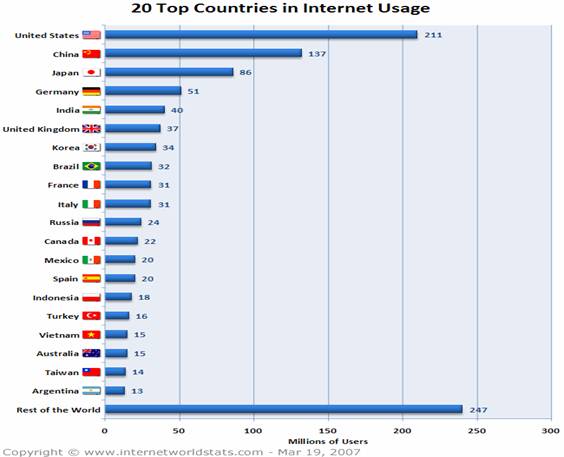

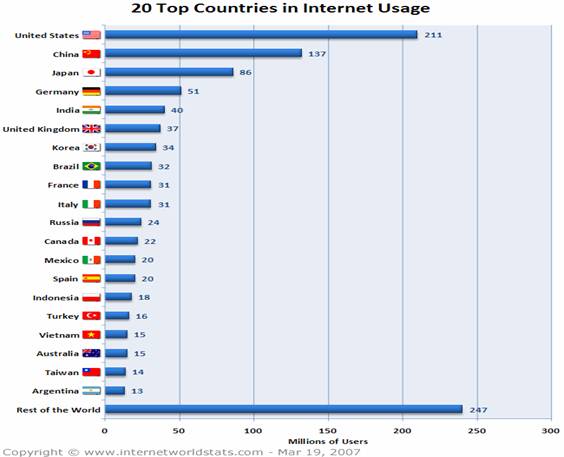

The Brazilian broadband market has enjoyed outstanding growth since late 2003. In terms of Internet user numbers, Brazil is ranked number eight in the world top 20 countries with the highest number of Internet users. Additionally, Brazil is the leader in Latin America; however, in terms of Internet user penetration, Brazil rates only slightly higher than the Latin American average.

Broadband access is split between ADSL , cable modem , satellite and radio (publicized as ' radio internet '), with some WiFi services. ADSL is the preferred broadband technology, although 2006 witnessed an unexpected increase in the proportion of cable modem versus ADSL users. The ADSL speeds are between 300 kbit/s to 1 Mbit/s, with some high-end options of 2, 4 or 8 Mbit/s, but at significantly higher prices. Wireless LAN ISPs are each day more common; in big cities some WiFi hotspots are available.

Furthermore, it is obligatory to contract with an "Internet Access Provider". According to the Brazilian Association of Internet Service Providers (ABRANET), there are currently more than 1,000 ISPs in Brazil , but only five large companies hold 50 percent of the market share in terms of Internet users. The market leader for paid Internet access is erra Lycos (owned by Spain 's Telefonica), followed by Universo Online (UOL), and Globo.

Internet Affordability - Stage 3

Access to the Internet is not a function of telecommunication infrastructure alone. Cultural, demographic, regulatory income level and distribution factors are with great influential too. Based on the Internet World States the Internet Users are 32,130,000 as of March 2007, which means only 17.2 % of the Brazilians access the Internet.

Internet Usage in South America |

|||||

Population |

Internet Users, |

% Population |

% Users |

Use Growth |

|

38,237,770 |

13,000,000 |

34.0 % |

19.2 % |

420.0 % |

|

9,492,607 |

480,000 |

5.1 % |

0.7 % |

300.0 % |

|

186,771,161 |

32,130,000 |

17.2 % |

47.4 % |

542.6 % |

|

15,818,840 |

6,700,000 |

42.4 % |

9.9 % |

281.2 % |

|

42,504,835 |

5,475,000 |

12.9 % |

8.1 % |

523.6 % |

|

12,090,804 |

968,000 |

8.0 % |

1.4 % |

437.8 % |

|

2,736 |

1,900 |

69.4 % |

0.0 % |

n/a % |

|

204,932 |

42,000 |

20.5 % |

0.1 % |

2,000.0 % |

|

886,113 |

160,000 |

18.1 % |

0.2 % |

5,233.3 % |

|

5,745,610 |

200,000 |

3.5 % |

0.3 % |

900.0 % |

|

28,920,965 |

4,600,000 |

15.9 % |

6.8 % |

84.0 % |

|

505,973 |

32,000 |

6.3 % |

0.0 % |

173.5 % |

|

3,271,771 |

668,000 |

20.4 % |

1.0 % |

80.5 % |

|

25,771,806 |

3,308,400 |

12.8 % |

4.9 % |

248.3 % |

|

TOTAL |

370,225,923 |

67,765,300 |

18.3 % |

100.0 % |

374.1 % |

Driving Force (why?)

Socio-economic factors influence access to Internet and computers. The higher the income in a given household, and the more educated the people in that household, the higher the access to computers and Internet. In 2005, Brazil had more than 15 million people that were considered to be illiterate . Furthermore, 31% of the population is below poverty line (2005), and the Unemployment rate is 9.6% (2006). All of these factors influence the Internet access. In addition, inequalities in Brazil are reflected on Internet access.

Challenges:

Cost: The price of a complete ADSL package (ISP + DSL) is currently in the region of R$ 90-120 / US$42-56. Dial-up Internet access costs as little as $11 month, and free access offers are becoming increasingly numerous. However, it is obligatory to contract with an "Internet Access Provider" which means additional payment must be made for an Internet provider, and this represents a high cost for a large portion of the population. Some municipalities do not have a local provider; therefore Internet cost becomes very high. A low cost data transmission media would be a feasible; for example, PLC (Power Line Communication), DPL (Digital Power Line) or BPL (Broadband over Power Line), it has a potential to be used as a tool to allow digital inclusion, and serve as an Internet access alternative to remote areas. This is especially true, given that in Brazil , electricity reaches above 96.7% of households.

Low PC penetration: According to data from the 2nd Survey on the Use of Information Technology and Communications in Brazil (TIC 2006), only 20% of the Brazilian population has computers at home , and 14% have Internet access at their houses. The survey also shows that 54.4% of the population never used a computer, and that 67% never accessed the Internet. (The survey was conducted by the Center for Information and Management of Ponto BR, a non-profit organization established to implement the decisions of the Internet Managing Committee. The survey was conducted in July and August 2006. More than 10,000 interviews were conducted in urban areas all over the country.)

- Lack of content: Only 1.4% of the web pages on the Internet are in Portuguese.

Network Speed and Quality

Development of every country is aided by the presence of high speed and high quality Internet. The speed and quality of Internet determines how efficiently a company or any organization can use it for its benefits. With respect to the speed bandwidth is considered as the backbone of the Internet. If the bandwidth is lower than it takes longer time for larger files to be transferred, this would reduce down the efficiency of Internet. The quality of Internet depends on how well the sent data reaches the destination. Some of the factors that determines of the quality of the network are mainline faults, poor connections, dropped connections, packet loss etc.

Brazil one of the developing countries is diffusing through the world of Internet. It is trying to make extensive use of Internet for its development. Till 1995 Internet was not used extensively in Brazil . Usage of Internet for commercial operations is launched in the year 1995, from then the number of users rapidly growing. As per Internet usage statistics in 2005 around 25,900,000 people uses Internet that represents 13.9 % of the total population and the number of users are increasing day by day. As the number of users are increasing and also the functions of the Internet the speed of the Internet is also being increased. In 2000 typical internet speed in Brazil was 256 Kbps but now speeds are between 300 Kbps to 1 Mbps. High speed options of 2, 4 or 8 Mbps is also available but at higher prices. This would aid industries that use Internet for the business process that includes Business to business commerce or business to client commerce. Since 2002 it was observed that majority of the people are migrating from dial up services to broadband. The major competing Internet providers in Brazil include Telefonica, Telemar, and BrasilTelecom. Now, Brazil is also equipped with Wi-fi services for the easier usage of Internet by the people.

Hardware and Software

Free and Open Source Software

According to the international media, Brazil is a leader in free and open source software (FOSS) adoption. The New York Times describes the country as "a tropical outpost of the free software movement," while BBC News claims that "Increasingly, Brazil's government ministries and state-run enterprises are abandoning Windows in favor of 'open-source' or 'free' software." However, FOSS advocates familiar with Brazil describe a less hopeful situation.

They talk about unsystematic support by the government, and a business atmosphere in which mention of FOSS is more about hype than understanding the underlying philosophy. They say violations of the GNU General Public License are commonplace. Some genuine FOSS adoption does happen, they say, but, too often, it is marred by inefficiency, and possibly widespread corruption.

During the first term of the government of Luiz Inacio Lula da Silva, which began in 2003, FOSS adoption was announced as a major policy. In addition to encouraging federal and state governments to switch to FOSS, Silva's government also used FOSS in PC Conectado, a program to make inexpensive computers available to the Brazilian public. The announcements of these initiatives created the impression internationally that Brazil would soon become an example of FOSS adoption to the rest of the world.

However, not only is the potential of this promising start yet to be realized, but there are signs that pro-FOSS policies are stalling. When Silva was re-elected in late 2006, his party's platform contained only one brief reference to free software -- a general promise to "improve direct and remote service-rendering to citizens, simplifying procedures, training civil servants and broadening the technological base, including the utilization of free software." Nothing of the earlier widespread plans for FOSS was in evidence. Possibly, this de-emphasis of FOSS is due to increased opposition by proprietary software interests, such as those trying to mount a constitutional challenge in the state of Rio do Sul against a law giving preference to FOSS solutions in the government.

Whatever the case, Brazilian advocates have learned to be skeptical about claims for FOSS. For example, although Conectiva (now part of Mandriva) widely publicized a deal with systems integrator Positivo that resulted in more than 90,000 computers shipped with Conectiva installed, Debian developer Gustavo Franco suggests that "almost all the users installed Microsoft Windows copies over that." Franco does not substantiate the claim, but his point is that lower-income Brazilians do not want free software as much as what they see on TV or in ads. Even if his suggestion is not completely true, it reflects the wariness that advocates have learned through bitter experience.

Interest in FOSS still exists throughout Brazil , but signs of progress are hard to see in 2007. "There're a lot of people doing almost nothing but talking a lot," says Debian developer Otavio Salvador.

Hype over quality

Some signs of FOSS adoption are still visible through Brazil , but FOSS observers are concerned about the quality of the code being released and where the efforts are being applied.

Gustavo Noronha Silva, another Debian developer, notes that the federal planning ministry is developing an inventory system called CACIC under the GNU General Public License in partnership with a public company called Dataprev. "The code is not that great," he says, "but they're bringing the free software concepts into the government, and are releasing real code and maintaining it."

Similarly, the Instituto Nacional de Tecnologia da Informaç a government software company, and SERPRO, Brazil 's official federal data processing service, have developed some free software courses and assisted in the migration of some government departments to FOSS. "I took part in some of this process when I was managing the IT of one of the ministries," says Silva, "and I could see that their job was very poor quality-wise, and with no planning at all."

Silva cites one case in which source packages were built on top of installed Debian packages and mixed Debian workstations with Windows-based desktop connections, and another in which email services were migrated without concern for the existing infrastructure. "They have done lots of damage," Silva says.

In another case, CAIXA, one of Brazil 's largest public banks, implemented its own Debian-based operating system. Silva says that the system "basically breaks if you try to upgrade it, so it's impossible to use sanely on servers" -- although that is where CAIXA is using it. He notes, however, that the release of the software was announced "in a big conference with lots of IT heads of the government." Silva's concern is that such efforts will discredit the whole concept of FOSS because of their poor performance, and represent a triumph of marketing over technical considerations.

Similarly, Franco is concerned about government plans to buy laptops from the One Laptop Per Child project. "I think the project is a good idea," Franco says, "but the government's goal is to put the laptops in the teachers' hands" rather than distributing them to lower-income citizens as the project intends

Franco also mentions rumors that some of the other attempts to deliver cheaper computers in Brazil "bundle dubious quality hardware with a random Linux distribution that doesn't fully support the hardware."

Silva's and Franco's concerns are that such efforts will discredit the whole concept of FOSS through missteps and poor performance. The fact that multinational companies such as IBM and Cisco are funding some government initiatives could only add to the disaster for FOSS. "The FLOSS hype in Brazil is a marketing thing," Franco writes in his blog, and, privately, Silva echoed the sentiment to NewsForge.{bb}

Brazil 's Computer Sector

The Brazilian protectionism in the 1980s was a combination of locally owned and some foreign companies manufacturing a wide range of hardware, and also designing software for the local market. By the end of the 1980s local production of IT equipment reached US$4.6 billion, with a high degree of local content both in technology and components. The Liberalization of the IT market for imports and foreign investment in the 1990s altered the industry structure. Multinational IT companies gradually took over most local firms and turned away from local design and manufacturing to imports. The surviving locally owned firms were oriented toward niche markets such as banking automation, client-specific software, and telecommunication equipment, where the client-supplier relationship was strong enough to withstand foreign competition.

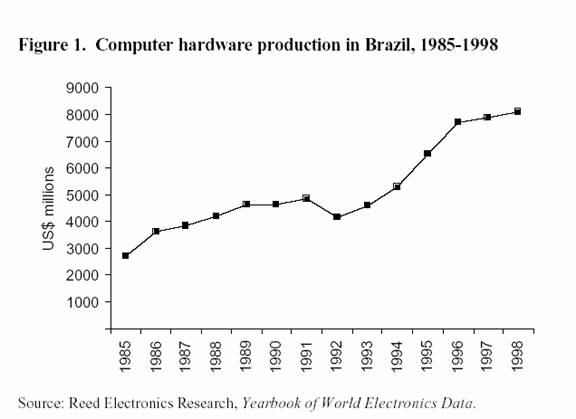

Computer Production

Computer hardware production in Brazil initially slumped after liberalization in 1991, as imports replaced domestically-produced hardware. However, production grew rapidly from1992 through 1996 as foreign and domestic producers expanded to serve the growing local market. Production leveled off again in 1997-1998 as the local economy suffered a downturn (Figure 1).

Brazil should see an increase in PC production in 1999 thanks to investments in production facilities by two major vendors, Dell and Gateway. Dell will begin producing computers in the second half of 1999 in a $75 million plant in Rio Grande del Sul.4 Dell plans to produce 250,000 units per year by the year 2000. Gateway also is entering the market in 1999 through its 23% investment in local PC maker Vitech (with an option to buy up to 100% eventually).

Most computer production in Brazil is done in Campinas , a city near São Paulo , which is the home to the production facilities of Compaq, IBM and Vitech, as well as other electronics companies such as Lucent, Philips and Motorola. Campinas offers a good infrastructure, proximity to the largest market in Brazil , a good supplier base, and has good universities that supply people and conduct R&D in conjunction with leading companies. Smaller production clusters are found in the Manaus free-trade zone in the Amazon region, Rio de Janeiro , and Rio Grande do Sul.

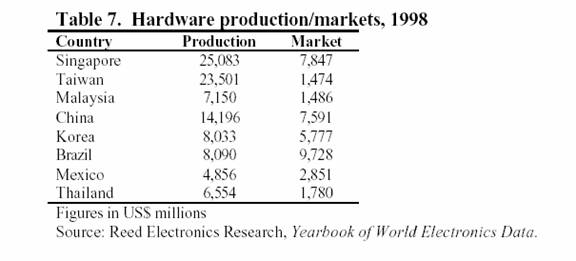

Table 7, which compares market and production of EDP products in selected developing countries and NICs shows that Brazil is a large producer, mainly because it has a large market to serve. Asian newly industrialized countries such as Singapore , Taiwan and Malaysia , in contrast, are world production centers and exporters of EDP equipment.

Peripheral equipment and components

One impact of the ascendance of foreign producers in the Brazilian IT industry is the rapid growth of contract manufacturing in the country. Following their global practices, Compaq and Epson already have outsourced all their production of integrated circuit boards used in Brazil , while Hewlett-Packard does the same for its printers. Large contract manufacturers such as Solectron (printed circuit boards and printers), SCI (printers) and Flextronics (computers and cell phones) have entered the Brazilian market alongside local firms like ABC-Bull (computers), TCE (monitors) and PCI Computadores (computers).

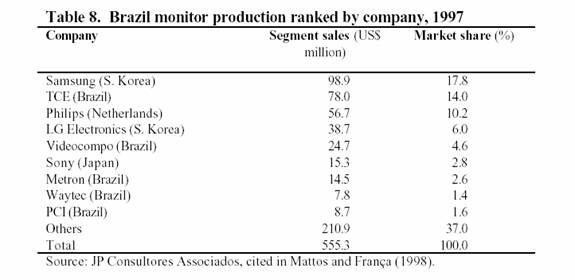

As the final market grows, local peripheral production has also grown and attracted major companies. For example, in 1997 monitor production was close to US$600 million, even though smuggling is still estimated to account for 45% of the market. In 1999, national firms produced 900,000 monitors, led by Samsung with 400,000 units. National and foreign firms divided the 1997 market, as shown in Table 8.

On the other hand, production in Brazil of electronic components has actually fallen from US$1.6 billion in 1991 to US$1.3 billion in 1998. The range of components produced by the industry also diminished significantly in the period. The reason for this decline is the opening of the market, and the inability of local producers to match the costs achieved by high-volume global producers of semiconductors and other components.

SERVICE & SUPPORT

Not only are Network Access and its combines service and support seen as an important determinant of national competitiveness in an increasingly globalized knowledge economy, they are also seen as offering new opportunities in areas such as education, health and social advancement. Brazil , a country of wide ranges of social and economic development, has put a high priority on improving access to advanced info-communications technologies, promoting digital literacy and improved access to government public services.

The economic and social benefits to the country arising from the spread of broadband go far beyond new service and support offerings. The technology will pave the way for a true revolution in the ability of lower income segments to access information, an essential component in Brazil 's quest to speed up the pace of its race toward development. Similarly, once broadband has been made available in both public and private schools and universities throughout the country, it will turn bold educational projects, such as distance education, into a reality.

One of the biggest issues that Brazil is facing right now is the long waiting period for installation and quick response to repair and troubleshooting issues for their customers. Though most of these local network businesses claim to maintain professional services 76% of their customers claim that they are dissatisfied with their response to customer service or any type of service request. Compared to other countries like the US this would be considered unacceptable and would be in direct violation to the Consumers Act. An example would be AT&T where their response period for any network access to their customers would be 1-2 business days.

Currently, broadband access in Brazil is achieved mainly by means of ADSL technology, which is dominated by the local telephone operators, that is, the incumbents. These companies control the telephone network, a fact that confers on them a virtual monopoly over the provision of ADSL service. Anatel is firmly committed to adopting measures that foster competition that will allow for price reductions and the continued improvement in the quality of broadband services.

Until recently, the only benefit of broadband in Brazil was the provision of Internet access at speeds higher than those offered by dial-up connections. Nevertheless, the emergence of new on-line services is transforming the demand for high-speed access. In the past several months, there has been an explosion in the development of content specifically intended for broadband applications. The transmission of television programs, video on-demand, games on-line, videoconferencing are but a few examples of the revolution in new services now being offered to Internet users.

As with other telecommunications services, the penetration of high-speed Internet services among the different consumer segments is not uniform. Recent studies show that, in the residential market, broadband Internet access is concentrated almost with the Brazilian Government's focus on providing its citizens with universal access to online services, comparative service and support. It has accurately realized that it needs to

pay closer attention to the topic of security and cyber-crime, including reviewing its legislative and regulatory frameworks . exclusively within socioeconomic classes A and B that are sectionized regions per state.

From speaking to the employees at Digitro they mentioned that the number one defining issue that their customers make as an important requirement in engaging in business agreements with them is the service and support package. Digitro claims to define them from their competitors with their variety of customized products and service and support packages available. Their mission statement claims that they are providing “Technology without limits” and that these factors are expected to be delivered to their customers. Neki Technologies was another company that pride themselves with service and support to their customers and working with them to reach their goals.